August 13, 2012 |

Woman of the Week: Lisa Hall

Woman of the Week Lisa Hall uses her work at Calvert Foundation to empower women-centered businessess and organizations through the Women INvesting in Women INitiative (WIN-WIN).

By Anna Louie Sussman

Lisa Hall knows that one opportunity can make all the difference. Hall, the president and CEO of Calvert Foundation, is the granddaughter of a North Carolina sharecropper. But her parents took advantage of educational opportunities, sending her and her sister to Harvard for graduate school.

After graduating with her Master’s in Business Administration, Hall worked as a loan officer at Chemical Bank, providing loans to low-income borrowers. Later, at Fannie Mae, she helped fund the construction of affordable housing. She then became the chief lending officer at Calvert Foundation, which promotes social impact investing in areas such as microfinance, environmental conservation, and women’s economic empowerment.

At Calvert Foundation, investors purchase Community Investment Notes in amounts as small as $20, and Calvert Foundation then lends that money to qualified organizations working to build and revitalize communities in the U.S. and around the world. When the organization repays its loan, the investor is paid back with interest. Currently, Calvert Foundation has nearly $200 million at work funding projects ranging from distributing clean cook stoves in Kenya to community health centers in poor American neighborhoods.

Recently, Calvert Foundation launched its Women INvesting in Women INitiative (WIN-WIN) to raise $20 million to fund women-centered businesses and organizations. Hall spoke to Women in the World Foundation about risk mitigation, the new draw of social impact investing, and why women’s rights are an economic issue.

At the Calvert Foundation, you’re putting investors’ money to work, and so far you have a 98 percent repayment rate from the organizations to which you lend (or, a 100 percent repayment rate – plus interest – to investors). How do you mitigate risk in your lending and ensure that you’ll get that money back?

Early on in my career, I was a loan officer with Chemical Bank, which used to be really well known for its credit training. So I learned how to analyze a balance sheet and an income statement, to look at the numbers and figure out whether they balance. Does the cash flow make sense? Secondly, I learned some of the fundamentals around lending. Character lending to me remains a core philosophy: the demonstrated ability and capacity and willingness to repay. You can mitigate a lot of the risk just by looking at borrowers’ track records.

If you’re very selective about whom you’ll lend to, how do you also ensure you’re having maximum social impact?

Somebody asked this recently at an event on social impact investing and I made a joke about it. I said, “We used to get criticized in the early days for cherry picking our borrowers. People were like, ‘You guys only want to lend to the best group,’ and our response was, ‘Yes. That’s the point.’”

I do think we were quite driven by the fact our money comes from individuals. We’re raising this capital from everyday people, and we feel really strongly that we want these people to get their money back. Some of them, not the typical investor, have literally put their retirement savings into this investment. We believe strongly in making sure our investors get paid, which makes us very diligent about underwriting and monitoring. We’re almost neurotic about it. That’s one of the reasons why we have had such a good record.

Why the focus on women now at Calvert Foundation?

Well, it is a pretty fascinating backstory. We were working with a potential donor, a woman, who was really interested in our model and wanted to support it by holding a fundraiser. When we met with her, she said, “Are we going to talk about something specific? What you do is great, but it’s so general, and I want something people can relate to.” We went through a couple of options: the work we do around the environment, around education, and then we said we do a lot of work that helps to economically empower women, and she said, “That, I can do. I can get a group of women in a room and that will resonate with them.”

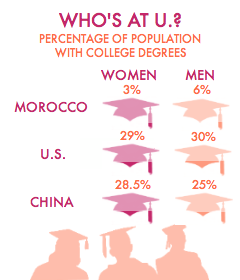

It coincided with some other work we had been doing and we had been thinking about gender lens investing. It’s all about throwing the power and influence women have behind controlling more and more wealth in this country. It coincided with a lot of the work that had been done at the World Bank around investing in women being smart economics.

We launched in early March and our goal is $20 million. We’ve raised $3 million in new investment capital from over 150 investors so far. We have a pipeline of $10 million in deals and have funded over $5 million in new loans. We’ve actually funded more deals now than we have raised money, so we pitched in with $2 million.

How does it work?

It’s a way for investors to connect with communities that they really care about it, in this case women, and it’s actually a model for our new strategy. You can invest twenty dollars, or if you want to go through your brokerage account instead of online, it’s available, so that’s really accessible. Most gender lens investing has minimums of $250,000 or more.

Another key element is connecting, which is a really new thing for us, this idea of connecting investors through social media, through all kinds of platforms, to communities that are underserved by capital. WIN-WIN obviously focuses on women; it allows women who care about women’s economic empowerment to be connected to those communities and the stories of these women and their lives. We think there is transformative power in this exchange of capital for both the investor and the recipient of the investment.

The last piece is the transform piece and it’s this very ambitious and audacious goal that we have. We’re trying to transform investment culture and we envision a world where every investor can be an impact investor. Our goal is that every single person who has an investment portfolio would have at least some portion of their portfolio allocated to impact. That’s what we mean when we say that every investor can be an impact investor.

What do you make of the rhetorical shift from “women’s rights are human rights” to “investing in women is smart economics”?

I think the shift is based in trying to get at the disease itself and not just the symptoms. So in some ways women’s rights and women’s equality is a symptom of economic injustice, which is the real disease.

If you’re creating economic opportunity for women, it’s related to violence against women. When a woman has the ability to walk away because she can pay her own rent or her own mortgage, that’s about economic empowerment, and it creates a very different circumstance for a man attacking her. So I think that’s part of the shift. People have looked closely to see, wait a minute, these things are completely related and you’re never going to get the full equality for women if you don’t get economic justice for women.

Anna Louie Sussman is a writer and editor for the Women in the World Foundation website, and a frequent contributor to major U.S. magazines and newspapers.